This will be a review of my holdings this year.

1) Performance of Individual Stocks Portfolio

My stock portfolio rose 14.7% in 2021, over-performing STI ETF (13.2%). My return was as high as 23% in mid-June 2021, lifted by bullish sentiments in HK small caps. However, it was pulled down in 2H 2022 by China stocks listed in HK

Year | % Returns | STI ETF (incl Dividends) |

2019 | 8.4% | 9% |

2020 | 3.6% | -8.6% |

2021 | 14.7% | 13.2% |

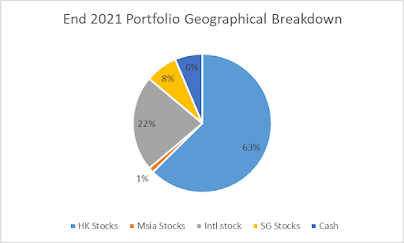

Probably, I should not be comparing to STI ETF, as my portfolio has mainly shifted to non-Singapore stocks. (In 2020, Singapore stocks are still half of my portfolio.) I guess that I will stick to the comparison to STI, since I have been comparing to it for many years.

2) Position Sizing

Excluding odd lots, I have 19 open positions in my individual stock portfolio. Moving forward, I think my stock portfolio will have fewer than 19 position, as I prefer more concentration in stocks that are good businesses.

| Number of Stocks |

At end 2016 | 21 |

At end 2020 | 39 |

At end 2021 | 19 |

3) SRS, ETF (VWRA) and Non-Stock Portfolio

I have other stuff besides my individual stock portfolio. It comprise

· SRS account (mainly STI ETF and a few stocks which I don’t trade much)

· ETF (VWRA)

· Bonds – mainly Singapore Savings Bond (SSB) and Astrea IV-VI Bonds listed in SGX

· CPFB accounts

· Cash

4) Approx 60-40 Allocation

I have sticked to approx. 60% stock to 40% non-stock portfolio allocation.

I wanted to reduce my cash allocation to more bonds. However, I do not want to buy into bonds ETF in environment where interest rates are expected to rise in future. I will put more cash into SSB and money market account next year to earn higher interest rates.

5) Net Asset Growth

I started keeping track on my net asset since 2014. My net asset has been growing annually.

The 2021 increase in net asset is driven by stock portfolio returns and my wages this year.