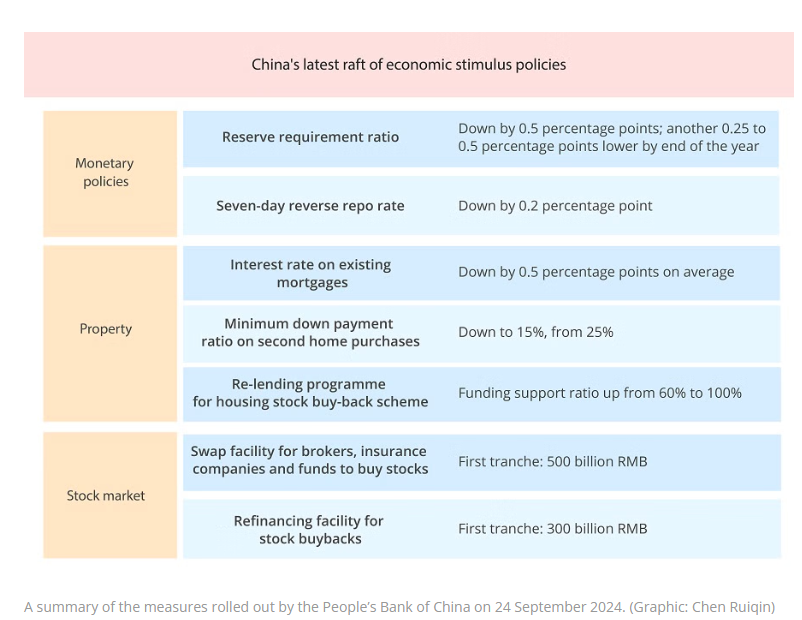

On 24 Sept 2024, China announced monetary stimulus which some described as mini-bazooka.

Source: https://www.thinkchina.sg/economy/can-chinas-latest-stimulus-package-save-its-economy

Since then, China government is holding more press conferences. One was by NDRC which was disappointing. The other was held by China Ministry of Finance on 12 Oct 2024, which noted

- more borrowings from China Govt to resolve the local govt debt

- money raised from special bonds will be used to buy unsold homes and turn them into subsidised housing.

No numbers or new measures were announced, as new measures may need approval from their meetings in Oct later.

More details: https://x.com/Sino_Market/status/1844960349130547641

Today (14 Oct 2024), there is another govt press conferenence on increasing support for companies. (See https://x.com/liqian_ren/status/1845647863188984221 )

From the above, there seems to be a U-turn in China policy.

In 2021, there were the 3-red lines for property developers and tech tech / education / gaming crackdown.

Now there are monetary stimulus, more govt borrowings and hopefully, some fiscal stimulus in future. China is realising that its economy needs help and its people need more confidence in the economy.

In medium term, I am hopeful of more support measures from China Govt, and China CPI should rise above 1% level.

I am also hopeful that China/HK markets may have bottomed. There will be some volatility but we are unlikely to see lower lows.

No comments:

Post a Comment